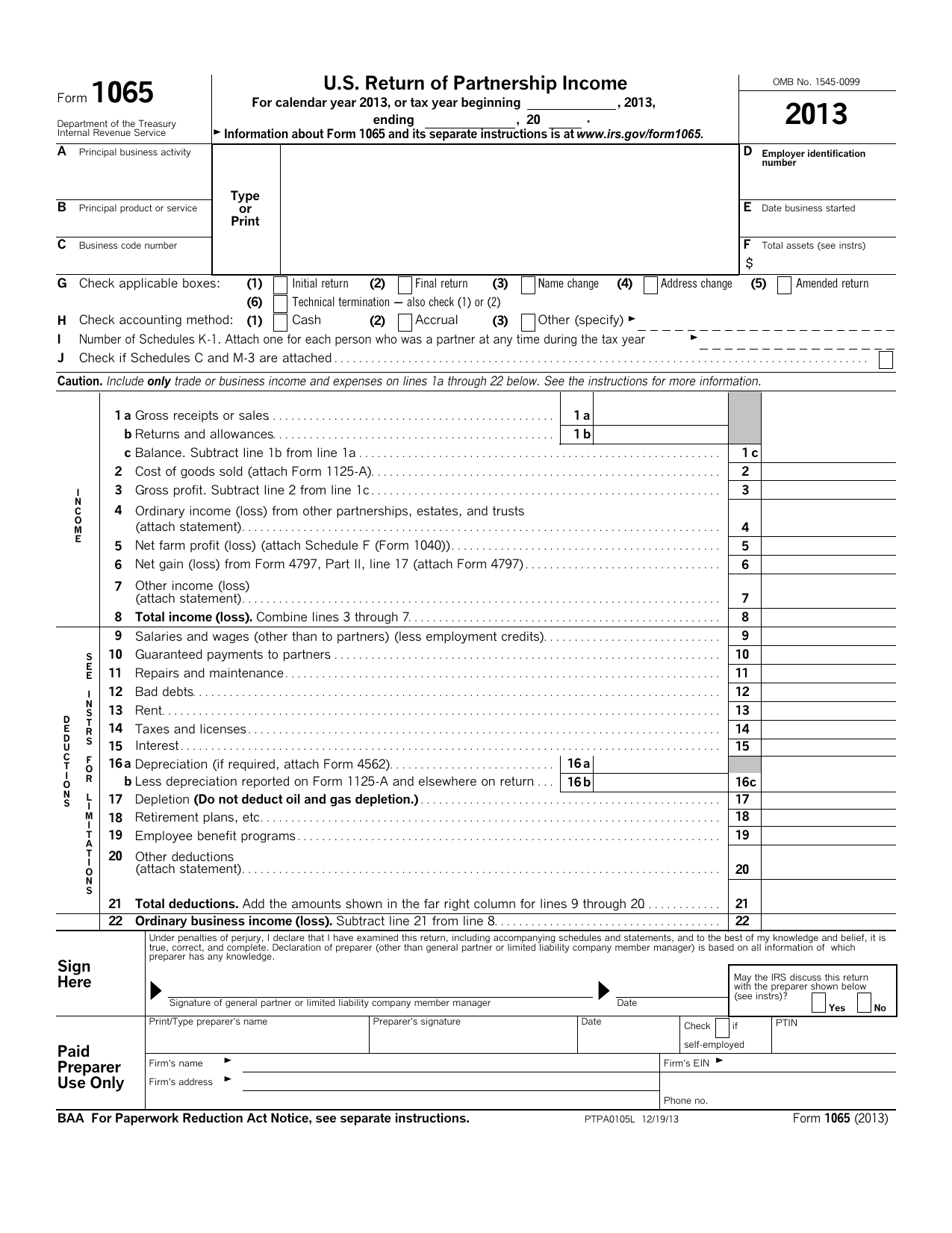

As a pass-through entity, you fill out IRS form 2553 so you only have to pay taxes on your partnership’s income at your own individual income tax rates. Here’s why: A partnership is a pass-through entity that reports its financial information so that partners can enter their share of it on their personal tax returns. However, you won’t use this form to calculate or pay taxes on your income. As the owner of a partnership or LLC, you’ll need to submit this form to the IRS every year. Return of Partnership Income?Įssentially, Form 1065 is an informational form you’ll use to report the business income, gains, losses, income deductions, and credits from your operations. Get started today What Is Form 1065: U.S. Full business credit reports & scores from Dun & Bradstreet, Experian and Equifax.

0 kommentar(er)

0 kommentar(er)